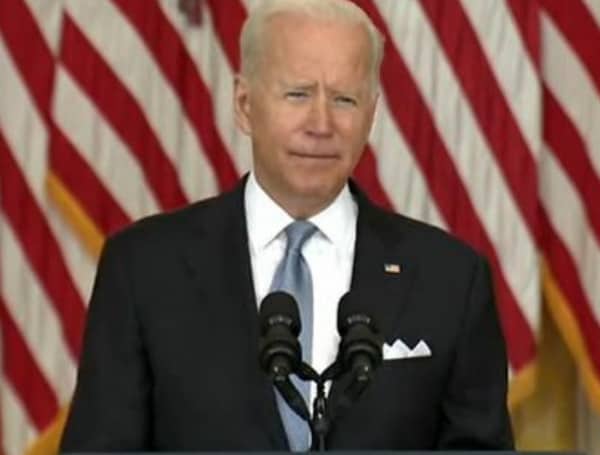

So often with President Joe Biden, it’s difficult to tell if he is lying or just doesn’t remember what he says.

But we now see that one of his most uttered campaign promises is set to fall by the wayside – if the Democrats can muscle it through.

Despite what Biden says, if you make less than $400,000 a year, your taxes are going up, if Congress can pass his massive social-welfare expansion bill, which some Democrats wanted to be enacted alongside the $1.2 trillion “infrastructure” bill that Biden recently enacted.

According to a report Tuesday by The Washington Times, the tax hikes uncovered by the congressional Joint Committee on Taxation on the middle class won’t happen right away.

The bill holds them off until 2023.

“Even after all [tax] credits are taken into account, taxpayers making between $50,000 to $75,000 annually would see a 0.3% tax increase starting in 2023. For those making between $75,000 and $100,000, the tax hike would be 2.9%,” the Times reported. “Individuals making between $100,000 and $200,000 would see a net tax hike of 7.4% in 2023.”

And those levies would continue.

“By 2031, taxpayers in the $50,000 to $75,000 [bracket] would see a net 1% hike in their taxes, while those in the $75,000 to $100,000 range would see a 2.9% increase. Meanwhile, those making between $100,000 to $200,000 see an overall tax hike of 11.3%,” the Times noted.

“More troubling is that Mr. Biden’s tax increases fall heaviest on the lower and middle class, while the super-wealthy receive a generous tax cut until at least 2025,” the paper added.

The reason is that the bill contains a provision that would allow wealthy elites, mostly in blue states, to write off state and local income taxes they pay.

For example, according to the Times, earners making between $200,000 and $500,000 in 2023 would receive a 12.7% tax cut because of that provision. Individuals making between $500,000 to $1 million would see a tax decrease of 35.5%.

To make that happen, Biden and congressional Democrats must reverse former President Donald Trump’s closing of that loophole.

On the other hand, the Times noted, “The tax increases that Mr. Biden is backing that will hit the less-wealthy include a provision doubling the federal tobacco tax to more than $2 per pack, new taxes on income derived from small businesses, and the closing of hundreds of various ‘loopholes’ and deductions.”

“Fiscal watchdogs also say that many of the tax increases formally geared toward corporations, including a new 15% flat tax on profits, will trickle down to lower-income brackets.”

Republican Sen. Mike Crapo of Idaho, the senior Republican on the Senate Finance Committee, told the Times, “This analysis proves that any suggestion this bill constitutes a broad-based middle-class tax cut is clearly false.”

“The analysis also documents that the Administration’s pledge that ‘no one with income below $400,000 will see their taxes go up’ is not true.”

Check out Tampafp.com for Politics, Tampa Local News, Sports, and National Headlines. Support journalism by clicking here to our GoFundMe or sign up for our free newsletter by clicking here. Android Users, Click Here To Download The Free Press App And Never Miss A Story. It’s Free And Coming To Apple Users Soon.