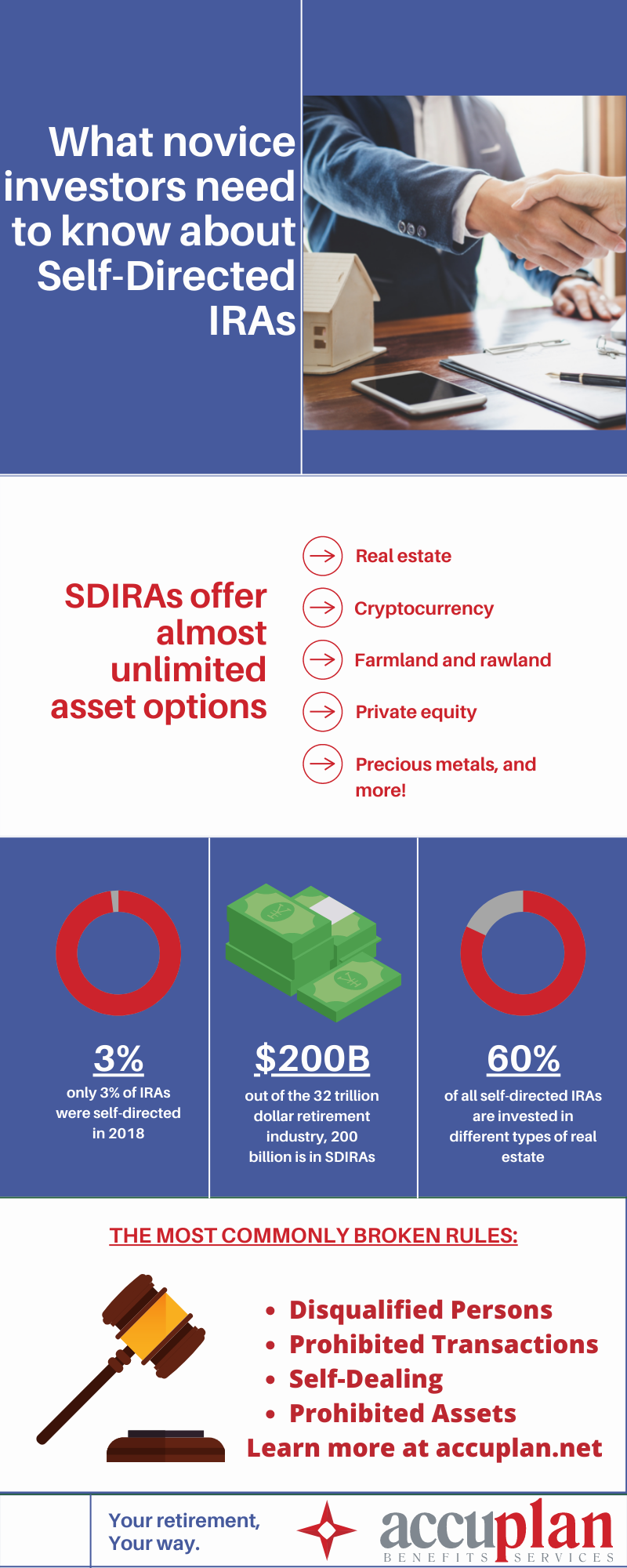

A self-directed IRA is an individual retirement account that will hold assets such as commodities, tax liens, real estate and limited partnerships to name a few.

This type of IRA is great for someone who wants to manage their own retirement fund. The assets you can and should invest in to place into an SDIRA, have changed.

Nowadays you can invest in cryptocurrencies, farmland, private equity and also precious metals.

Did you know that there are over $200 billion invested into SDIRAs? But, only 3% of IRAs were Self-directed IRAs in 2018. This means many people either don’t know they can manage their own IRA fund and include various assets, or they simply want some fund manager to do it all for them.

The most important thing to know is, 60% of SDIRAs are invested in all types of real estate, as this is an asset type that has a low percentage of depreciation.

But many times, SDIRAs have been denied because of some common rules being broken. There will be prohibited sanctions that you cannot have, self-dealing is off limits and also holding or putting in prohibited assets are a few things to be aware of.

If you have been caught doing prohibited transactions while having an SDIRA, you will have it denied as well.

“If you would like to know more about Self-direction IRAs and want to avoid breaking the rules, invest in the best assets, feel free to ask us anything,” said Accuplan in a statement.

Infography by accuplan Novice investor

- Florida Gov. DeSantis Expresses Concern About Biden Admin Cutting Supply Of Effective Antibody Treatments

- A Message From Florida’s New Public Health Chief: The State Will ‘Completely Reject Fear As A Way Of Making Policies In Public Health’

- Florida Man Steals Pickup Truck, Crashes, Pretends To Grill On Strangers Porch

- “Gut Him” Florida Woman Pulls Knife On Man After Dispute Over Her Passing Gas At Dollar General

- Florida Man And Woman, In Colorful Simpsons Shirts, Arrested On Multiple Drug Charges

- “Snickers Satisfies” Florida Man Arrested After Armed Robbery Of A Snickers Bar At Wawa

- Oops: Another Florida Pro-Mask Mandate Lib Caught Partying It Up Without A Mask

Support journalism by clicking here to our gofundme or sign up for our free newsletter by clicking here

Android Users, Click Here To Download The Free Press App And Never Miss A Story. It’s Free And Coming To Apple Users Soon.