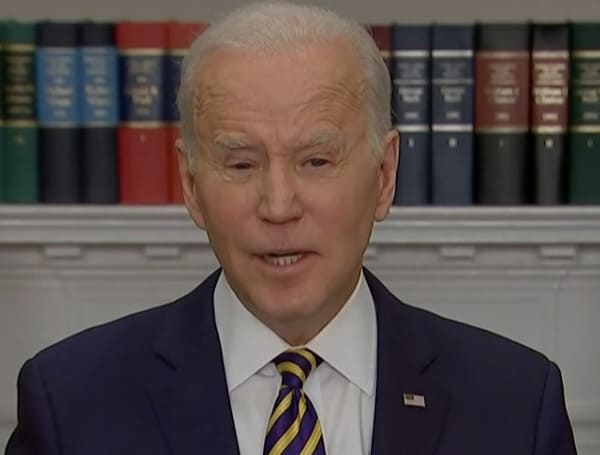

A “wealth tax” on America’s high-achievers and producers has long been a dream of the left. President Joe Biden, the self-described “capitalist,” is apparently ready to deliver it to them.

Newsmax, citing a report by The Washington Post, noted Biden’s proposed 2023 budget will include a new 20 percent minimum tax that specifically targets America’s richest 700 billionaires.

“The Billionaire Minimum Income Tax will ensure that the very wealthiest Americans pay a tax rate of at least 20 percent on their full income,” the White House said in documents obtained by the Post. “This minimum tax would make sure that the wealthiest Americans no longer pay a tax rate lower than teachers and firefighters.”

The new minimum tax, set to be unveiled Monday, would be slapped on U.S. households worth more than $100 million a year, Newsmax reported. That would generate an estimated $360 billion in new revenue to the federal government during the next 10 years.

And what makes the tax even more preposterous, according to Newsmax, is that “it would tax not only traditional income and capital gains, but also include ‘unrealized’ gains, or amounts of money earned on investments that have not been sold.”

In other words, America’s prime earners will be taxed on income they haven’t even made yet.

“The move is expected to help cut the deficit by an estimated $1 trillion during that [10-year] period,” Newsmax added.

Sure.

As The Free Press has noted, former President Donald Trump’s 2017 tax cuts, which are still in effect, have generated record amounts of revenue for the federal government.

Earlier this month, CNSNews.com columnist Terrence Jeffrey pointed out that the federal government hauled in a record amount of tax revenue during the first five months of fiscal year 2022.

Overall, that amount came to $1.8 trillion.

Slightly more than half of that – $973 billion – was collected from individual income taxes, Jeffrey reported.

Last August, a study by the left-leaning Tax Policy Center noted that 61 percent of U.S households paid no federal income taxes in 2020.

The right-leaning Tax Foundation pointed out that was up from 43.6 percent in 2019.

As The Hill noted in reporting on the TPC study that the group expected that number to slightly drop for 2021, down to 57 percent.

“The households that are estimated to pay no federal income taxes this year primarily have low- and middle-incomes,” The Hill said.

Such data, as found in the TPC report, prompted U.S. Sen. Rick Scott to recently call for all households to pay something, if only a little and if only to have “skin in the game.”

So here are some questions for Biden; Who do you think was paying all those federal income taxes in 2020, when 61 percent of households paid nothing? And who will pay it again for 2021, when that drops to 57 percent? Who is responsible for the record income-tax receipts now pouring into D.C?

The answer is that it is people like Elon Musk, who recently tweeted that his income tax liability for this year will run $11 billion.

The Democrats’ tendency to ignore facts and still stoke class envy and resentment never cease to amaze.

Visit Tampafp.com for Politics, Tampa Area Local News, Sports, and National Headlines. Support journalism by clicking here to our GiveSendGo or sign up for our free newsletter by clicking here.

Android Users, Click Here To Download The Free Press App And Never Miss A Story. Follow Us On Facebook Here Or Twitter Here.