President Donald Trump’s top economic adviser, Kevin Hassett, said Sunday on Fox News that taxing the wealthiest Americans isn’t currently part of the plan to fund the president’s “no tax on tips” push.

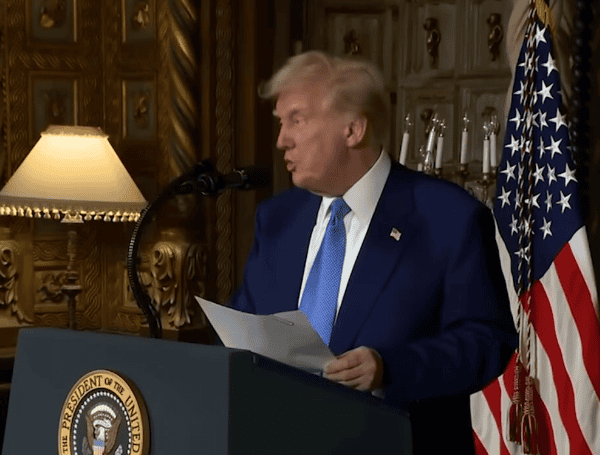

Urging Congress to pass his “big, beautiful” budget bill, Trump’s plan is expected to lean on his 2017 tax cuts, immigration enforcement, and increased defense spending to advance his legislative agenda. While on “Sunday Morning Futures With Maria Bartiromo,” the Fox host asked Hassett whether raising taxes on “the highest earners” would be considered to cover the cost.

“No, it’s not in the plan right now,” Hassett said. “But the president is clear that he’s got the objectives that he wants to achieve for the American worker like no tax on overtime. That no tax on overtime, by the way, it’s a huge benefit. We were doing some estimates that for a typical unionized worker might be 100, 200 dollars a week. He’s got those things as top priorities in the bill.”

READ :U.S. Announces Trade Deal Reached With China In Geneva

In the months before the November 2024 election, Trump began pitching a plan aimed at middle-class Americans, vowing in June to eliminate taxes on tips earned by service workers if reelected. Notably, two months after Trump’s announcement, former Vice President Kamala Harris endorsed the same idea — prompting Trump to accuse her of “copying” him.

While Trump has been working with House Republicans to push the budget bill through —potentially as early as Memorial Day — the president appeared to walk back on Friday any suggestion of raising taxes on the wealthy.

“He understands that the House and Senate might have their priorities and he just said that if he doesn’t think they should do it but if they did it then he wouldn’t veto the bill is basically what he said,” Hassett continued. “But it’s probably not going to happen. He literally is putting his priorities first and those priorities are in both versions of the bill that I’ve seen.”

In a post on Truth Social, Trump wrote that the problem with “even a ‘TINY’ tax increase” on the wealthy is the backlash it would trigger from the “Radical Left Democrat Lunatics.” While he noted Republicans probably shouldn’t include the hike, he added he’d still sign off on a bill that did.

“The problem with even a ‘TINY’ tax increase for the RICH, which I and all others would graciously accept in order to help the lower and middle income workers, is that the Radical Left Democrat Lunatics would go around screaming. ‘Read my lips,’ the fabled Quote by George Bush the Elder that is said to have cost him the Election,” Trump wrote.

“NO, Ross Perot cost him the Election! In any event, Republicans should probably not do it, but I’m OK if they do!!!” Trump added.

READ: 21 States Back Trump Administration In Federal Workforce Lawsuit

After passing the budget bill’s blueprint on April 10, the GOP-led plan is expected to unlock over $100 billion for immigration enforcement, authorize new defense spending, and carve out permanent tax cuts. In April, Republicans pushed back on raising taxes for those earning over $1 million annually, with some telling the Daily Caller News Foundation they wouldn’t support a bill that included the increase.

Please make a small donation to the Tampa Free Press to help sustain independent journalism. Your contribution enables us to continue delivering high-quality, local, and national news coverage.

Connect with us: Follow the Tampa Free Press on Facebook and Twitter for breaking news and updates.

Sign up: Subscribe to our free newsletter for a curated selection of top stories delivered straight to your inbox.

First published by the Daily Caller News Foundation.