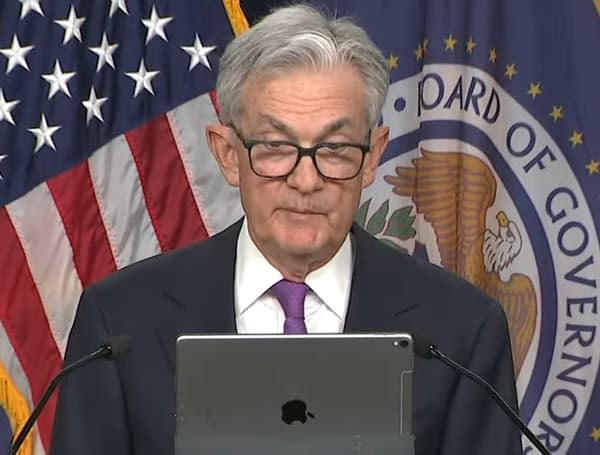

U.S. President Donald Trump today intensified his criticism of Federal Reserve Chair Jerome Powell, accusing him of stifling American economic growth and costing the nation “a fortune” by maintaining current interest rates.

The President called for a substantial “full point” reduction in the benchmark rate, arguing that such a move would inject “Rocket Fuel” into an already robust economy.

President Trump’s remarks come as fresh federal employment data shows the U.S. added a higher-than-expected 139,000 jobs in May. Furthermore, inflation has continued its downward trend, reaching a near four-year low of 2.3 percent in April.

READ: Trump, Musk Signal Potential Thaw After Public Spat

“America is hot,” the President declared earlier, highlighting what he sees as prime conditions for lower borrowing costs.

Taking to his Truth Social platform Friday morning, President Trump posted, “‘Too Late’ at the Fed is a disaster!” using his often-used nickname for Powell. He drew a stark comparison to Europe, stating, “Europe has had 10 rate cuts, we have had none. Despite him, our Country is doing great. Go for a full point, Rocket Fuel!”

The President has repeatedly pressed Powell to cut rates, including in a recent in-person meeting at the White House on May 29. However, the Fed has held its benchmark interest rate steady at 4.25 percent to 4.5 percent for three consecutive policy meetings.

The central bank’s rate-setters are reportedly waiting for more data, balancing their dual mandate of price stability and maximum employment amid concerns about the potential impact of ongoing trade conflicts on inflation and growth. Higher rates are typically used to cool inflation by tightening the money supply, though they can also lead to higher unemployment.

READ: U.S. Job Market: Steady As She Goes, But Keep An Eye On The Details

President Trump elaborated on the financial benefits of a rate cut, stating, “If ‘Too Late’ at the Fed would CUT, we would greatly reduce interest rates, long and short, on debt that is coming due. Biden went mostly short-term.” He further asserted, “There is virtually no inflation (anymore), but if it should come back, RAISE ‘RATE’ TO COUNTER. Very Simple!!! He is costing our Country a fortune. Borrowing costs should be MUCH LOWER!!!”

The President’s persistent calls for lower rates underscore his belief that current monetary policy is holding back the American economy from reaching its full potential, particularly in an environment of strong job growth and cooling inflation. The Federal Reserve, however, appears to remain cautious, prioritizing a data-driven approach to navigate an uncertain economic landscape.

Please make a small donation to the Tampa Free Press to help sustain independent journalism. Your contribution enables us to continue delivering high-quality, local, and national news coverage.

Connect with us: Follow the Tampa Free Press on Facebook and Twitter for breaking news and updates.

Sign up: Subscribe to our free newsletter for a curated selection of top stories delivered straight to your inbox.