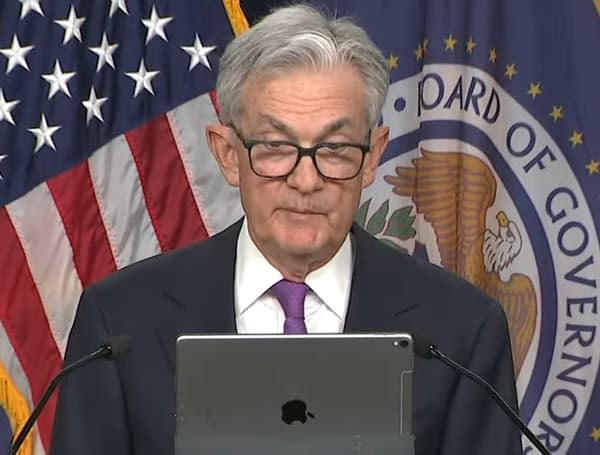

Federal Reserve Chair Jerome Powell announced today that the central bank’s policymaking arm, the Federal Open Market Committee (FOMC), has voted to maintain its target range for the federal funds rate at 4.25% to 4.5%, signaling a pause in its cycle of interest rate adjustments.

The decision came at the conclusion of the Fed’s latest policy meeting, where officials opted for continuity in monetary policy amidst an economy described by Powell as being in a “solid position” despite “heightened uncertainty.”

READ: Feds Launch Sweeping Probes Into 45 Universities Over Race Discrimination Allegations

Speaking after the meeting, Powell emphasized the Fed’s unwavering focus on its dual mandate: achieving maximum employment and stable prices for the American people. He highlighted the current economic landscape, noting that the unemployment rate remains low and the labor market is assessed as being “at or near maximum employment.”

While acknowledging significant progress in bringing down inflation from its peak in mid-2022, Powell stated that it “has been running somewhat above our two percent longer run objective.” The latest data showed total PCE prices rose 2.3% over the 12 months ending in March, with core PCE, which excludes volatile food and energy prices, increasing by 2.6%.

A notable point of discussion was the impact of evolving trade policy. Powell acknowledged that GDP growth in the first quarter had “edged down,” complicated by “unusual swing” in net exports likely driven by businesses importing goods ahead of potential tariffs. He pointed to private domestic final purchases (PDFP) as a better indicator of underlying growth, which grew at a solid 3% rate in the first quarter, consistent with the previous year’s pace.

READ: Virginia School Probes Boys Who Complained About Trans Student Taking Video In Locker Room

However, surveys of households and businesses reveal a “sharp decline in sentiment and elevated uncertainty about the economic Outlook, largely reflecting trade policy concerns.” Powell noted it “remains to be seen how these developments might affect future spending and investment.”

Powell directly addressed the potential economic consequences of sustained, large increases in tariffs, stating they are “likely to generate a rise in inflation, a Slowdown in economic growth and an increase in unemployment.” While the inflationary effects could be temporary, reflecting a one-time price level shift, there is a possibility they could become “more persistent.”

The Fed Chair underscored the central bank’s obligation to keep longer-term inflation expectations “well anchored” to prevent a one-time price shock from evolving into an ongoing inflation problem. He acknowledged the challenging scenario where the dual mandate goals might be in tension, stating the committee would consider the deviation from each goal and the time horizons for closing those gaps if such a situation arose.

READ :Four Honduran Nationals Indicted In $89 Million ‘Undocumented Workers’ Tax Scheme In Florida

For now, Powell stated, the current stance of monetary policy leaves the Fed “well positioned to respond in a timely way to potential Economic Developments” and is “well positioned to wait for greater Clarity before considering any adjustments to our policy stance.”

The FOMC also decided to continue reducing the size of its balance sheet as part of its ongoing strategy. Powell mentioned the committee also continued discussions on its five-year review of its monetary policy framework during the meeting.

Please make a small donation to the Tampa Free Press to help sustain independent journalism. Your contribution enables us to continue delivering high-quality, local, and national news coverage.

Connect with us: Follow the Tampa Free Press on Facebook and Twitter for breaking news and updates.

Sign up: Subscribe to our free newsletter for a curated selection of top stories delivered straight to your inbox.