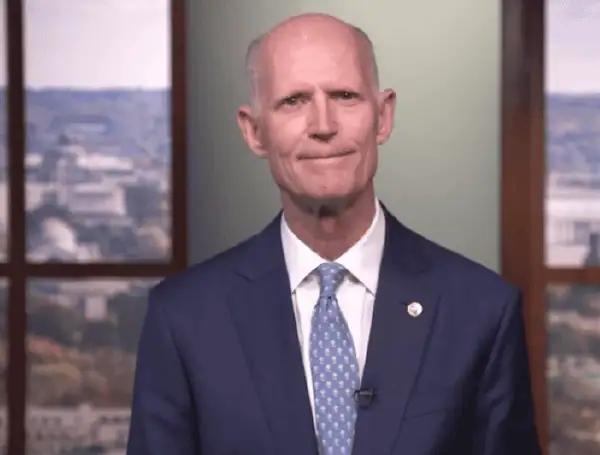

As hurricane season swirls into full swing, Senator Rick Scott today launched a legislative offensive aimed at revolutionizing the beleaguered National Flood Insurance Program (NFIP). His proposed package promises to deliver much-needed relief to families grappling with soaring premiums and limited choices, particularly in flood-prone states like Florida.

Senator Scott, a vocal critic of the NFIP’s “wildly inefficient” and “unaffordable” history, declared his three-bill package a “textbook case of what happens when big government tries to take over an industry – complete failure.” He’s determined to usher in an era of transparency, competition, and affordability for homeowners.

READ :Missouri Sen. Josh Hawley Grills 23andMe CEO Over Data Retention Ahead Of Bankruptcy Sale

“With hurricane season underway, families in Florida and across the nation have flood insurance top of mind and are seeking access to affordable, reliable coverage when they need it most,” Senator Scott stated. “My legislative package works to reform the NFIP by increasing transparency in the system and encouraging more private-sector participation, allowing for a robust and affordable flood insurance market that gives homeowners in Florida choices and flexibility with their flood insurance plans.”

The centerpiece of Scott’s reform effort rests on three key pieces of legislation:

The Flood Insurance Transparency Act: This bill demands that the Federal Emergency Management Agency (FEMA) pull back the curtain on its data, requiring them to make detailed historic claims, policy, and flood risk information publicly and easily accessible, all while safeguarding personal information. No more hidden figures, says Scott, just clear data for all to see.

READ: U.S. Government Sues New York Over Immigration Enforcement Laws

The Flood Insurance Consumer Choice Act: A direct response to the NFIP’s rigid “Continuous Coverage” rule, this act throws a lifeline to policyholders. It allows those who venture into the private insurance market to return to the NFIP without penalty, fostering a true “try before you buy” mentality in the flood insurance world.

The Removing Barriers to Private Flood Insurance Act: This bill takes aim at a significant roadblock for private insurers: the NFIP’s “Write Your Own (WYO)” company non-compete clause. By permanently scrapping this clause, WYO companies will finally be free to offer private flood insurance products that directly compete with NFIP offerings, unleashing the power of the private market.

READ :Florida Rep. Steube: DOE Facilities Off-Limits To Most Non-Citizens, ‘Five Eyes’ Only Exception

For years, Florida policyholders have felt the sting of an NFIP system where their premiums often outstripped their claims reimbursements.

Senator Scott’s legislative push aims to rectify this imbalance, promising a future where flood insurance is not a burden, but a readily available and affordable safeguard for families facing the unpredictable forces of nature. The fight for fairer flood insurance has just begun, and Senator Scott is leading the charge.

Please make a small donation to the Tampa Free Press to help sustain independent journalism. Your contribution enables us to continue delivering high-quality, local, and national news coverage.

Connect with us: Follow the Tampa Free Press on Facebook and Twitter for breaking news and updates.

Sign up: Subscribe to our free newsletter for a curated selection of top stories delivered straight to your inbox.