Florida TaxWatch today released its annual 2025 Budget Turkey Watch Report, an independent analysis highlighting questionable appropriations within the state’s $115.1 billion budget for Fiscal Year 2025-26. The report identifies 242 items, totaling $416.1 million, that meet the criteria of “Budget Turkeys” – appropriations that bypass or violate established budget procedures, legislative scrutiny, or public oversight.

In addition to these designated “Budget Turkeys,” the report also shines a light on an additional $799.5 million in member projects that, while not strictly meeting the turkey criteria, warrant “extra scrutiny and close gubernatorial review.”

Dominic M. Calabro, President and CEO of Florida TaxWatch, emphasized the long-standing significance of the report, stating, “Since 1983, the term ‘Budget Turkey’ has become synonymous with Florida TaxWatch, and our report has an enviable acceptance by Republican and Democratic governors these many decades and helps provide our state’s taxpayers with a final check and balance in spending their hard-earned money.”

READ: Senate Republicans Unveil “Big Beautiful Bill” Draft With Medicaid Work Requirments, Tax Breaks

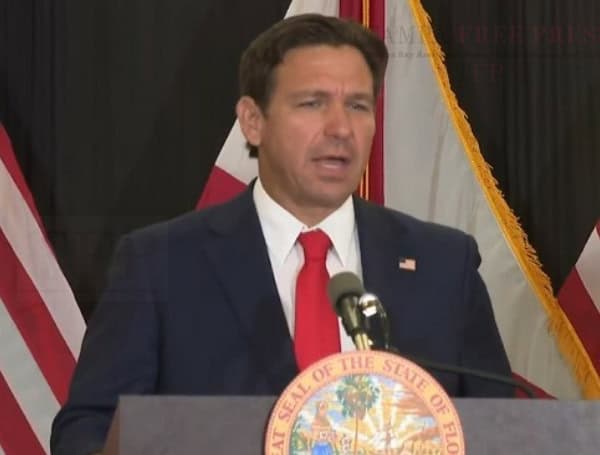

Calabro clarified that the “Budget Turkey” label does not inherently imply a judgment on a project’s merit or value. Instead, he urged Governor DeSantis to critically assess each flagged project – whether a “Turkey” or otherwise – to determine if its funding aligns with sound budgeting practices, addresses a core state government function, and was selected through a fair process that prioritizes the best interests of Florida’s taxpayers.

The FY2025-26 budget includes approximately 1,600 local member projects exceeding $2 billion. Florida TaxWatch notes that the last three budgets have consistently funded at least $2.8 billion in member projects, and the current budget could approach that threshold. With 160 legislators, this averages out to 10 projects and $17 million per member, though some legislators receive significantly more funding than others.

While these member projects are not classified as “Budget Turkeys,” Florida TaxWatch advocates for subjecting them to a statutorily defined competitive review and selection process. This, they argue, would ensure prioritization, fair competition for limited funds, and a coordinated, statewide vision that addresses critical issues such as attracting and retaining a skilled workforce across various industries.

READ: No Standing: Judge Blocks Unions’ Attempt To Force Feds To Reinstate Columbia’s $400M

Jeff Kottkamp, Executive Vice President and General Counsel for Florida TaxWatch, commended the Legislature for constructing a smaller budget than the previous year, a reduction of approximately $3.5 billion.

However, he urged Governor DeSantis to provide “especially close scrutiny” to the $799.5 million in specific line items identified in the report. Kottkamp further explained that “Budget Turkeys” tend to serve limited, rather than statewide, areas, often fall outside core state government functions, are more appropriately funded locally or privately, and circumvent established budget procedures, competitive selection, oversight, and accountability.

The core principle behind the Budget Turkey Watch Report is transparency and accountability in taxpayer dollar allocation. All appropriations, particularly those requested by individual legislators, should undergo rigorous review, especially given their often local scope and non-core government functions.

READ: Florida Rep. Byron Donalds’ Campaign Blasts David Jolly’s “Radical Democrat Values”

Kurt Wenner, Senior Vice President of Research for Florida TaxWatch, highlighted a growing concern: “The lack of a systematic review and selection process in some areas of the budget has become a glaring problem.” He noted an increasing trend of local projects being funded through the state budget, often clustered within specific line-items. Florida TaxWatch recommends that if the Legislature continues to fund such projects, it must establish a competitive review and selection process in statute for each of these areas.

On a positive note, Florida TaxWatch lauded the Legislature for its final step in eliminating the Business Rent Tax (BRT), a long-advocated measure by the organization, benefiting entrepreneurs across the state. They also commended the permanent Back-to-School Sales Tax Holiday in August and sales tax breaks for disaster preparedness, recognizing these as meaningful tax relief for Florida families and businesses.

The report serves as a guide for Governor DeSantis during his budget deliberations. Florida TaxWatch encourages him to not only consider a project’s value and efficacy but also whether it meets the “Budget Turkey” criteria, addresses a core state government function, and was selected through a fair process that promotes the best interests of taxpayers statewide.

READ: Summer Sizzle: Expansive Heat Wave To Grip Central And Eastern U.S.

Florida TaxWatch’s “Budget Turkey” criteria include:

- Projects that circumvent established review and selection processes or are funded ahead of higher priority projects.

- Appropriations inserted during conference committee meetings, not appearing in either the final Senate or House budgets.

- Appropriations from inappropriate trust funds, duplicative appropriations, or appropriations contingent on failed legislation.

- Appropriations removed by agreement in conference but added back at the last minute via “sprinkle” lists.

Please make a small donation to the Tampa Free Press to help sustain independent journalism. Your contribution enables us to continue delivering high-quality, local, and national news coverage.

Connect with us: Follow the Tampa Free Press on Facebook and Twitter for breaking news and updates.

Sign up: Subscribe to our free newsletter for a curated selection of top stories delivered straight to your inbox.