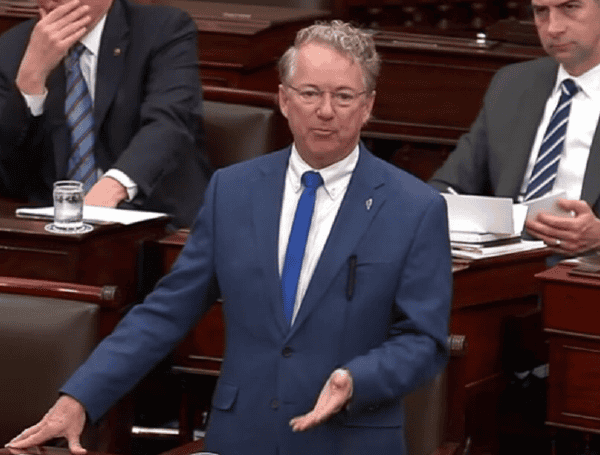

Kentucky Senator Rand Paul has reintroduced the “Tan Tax Repeal Act,” a bill aimed at eliminating the 10 percent excise tax on indoor tanning services.

The tax, a provision of the Affordable Care Act (ACA) enacted in 2010, has been criticized by Senator Paul and his cosponsors as a “job-killing” measure that disproportionately harms small businesses and women entrepreneurs.

The legislation, cosponsored by Senators Ted Budd (R-NC), Kevin Cramer (R-ND), and Pete Ricketts (R-NE), seeks to undo a tax that Senator Paul argues was never about public health. “This tax was never about public health—it was about squeezing more money out of hardworking Americans to fund a broken government program,” Dr. Paul stated.

READ: Kentucky Sen. Rand Paul Cites “Mrs. Wilson” Parallel, Warns Of “Catastrophe” In Biden Cover-Up

He further characterized the tax as an example of the federal government unfairly favoring some businesses over others, specifically “punishing women-owned businesses trying to stay afloat in a tough economy.”

The “Tan Tax” was reportedly introduced as a last-minute substitute for a proposed “Botox tax” during the drafting of the ACA. Since its implementation, the American Suntanning Association reports that over 11,000 tanning salons, many of them women-owned, have closed their doors.

This has led to an estimated loss of more than 110,000 jobs, predominantly held by women. The tax has also been cited as a factor in the decline of domestic tanning equipment manufacturing, with jobs and production reportedly shifting to foreign countries.

READ: Demerits For Cuomo, Millions For Adams As New York City Campaign Finance Board Acts

Dr. Paul has been a long-standing opponent of the Affordable Care Act and has consistently advocated for the repeal of what he considers overreaching policies, including the Tan Tax. He has previously included this repeal in his broader legislative efforts to replace the ACA.

The “Tanning Tax Repeal Act of 2025,” as designated in the bill, proposes to amend the Internal Revenue Code of 1986 by striking chapter 49, which pertains to the excise tax on indoor tanning services. If enacted, the amendments would apply to services performed after the date the bill becomes law.

Please make a small donation to the Tampa Free Press to help sustain independent journalism. Your contribution enables us to continue delivering high-quality, local, and national news coverage.

Connect with us: Follow the Tampa Free Press on Facebook and Twitter for breaking news and updates.

Sign up: Subscribe to our free newsletter for a curated selection of top stories delivered straight to your inbox.