President Donald Trump intensified his criticism of Federal Reserve Chair Jerome Powell on Thursday, issuing his strongest suggestion yet that he intends to fire the nation’s top economic policymaker.

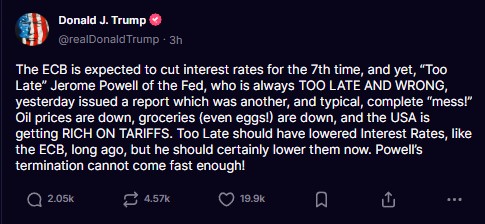

In a fiery post on Truth Social, Trump declared, “Powell’s termination cannot come fast enough!”—a statement that has reignited concerns about the independence of the Federal Reserve and its ability to navigate an economy strained by Trump’s aggressive tariff policies.

Trump’s attack follows Powell’s Wednesday warnings about the economic consequences of the president’s sweeping tariffs, which the Fed chair said on April 16, 2025, at the Economic Club of Chicago, are “significantly larger than anticipated” and likely to result in “higher inflation and slower growth.”

READ: California Sues Trump Admin Over Tariffs, Citing Economic Harm And Unconstitutional Action

Powell cautioned that the tariffs could lead to a “challenging scenario” for the Fed, potentially causing persistent inflation rather than a temporary spike, a situation he described as a risk to the Fed’s dual mandate of maintaining stable prices and maximizing employment.

“While tariffs are highly likely to generate at least a temporary rise in inflation, it is also possible that the effects could be more persistent,” Powell said, emphasizing the Fed’s obligation to prevent a one-time price increase from becoming an ongoing inflation problem.

The Fed has kept interest rates steady at a range of 4.25% to 4.5% since December 2024, adopting a wait-and-see approach amid uncertainty over Trump’s policies.

Powell reaffirmed this stance on Wednesday, stating, “We are well positioned to wait for greater clarity before considering any adjustments to our policy stance.” However, this cautious approach has drawn Trump’s ire. In another Truth Social post just before Powell’s speech, Trump insisted, “This would be a PERFECT time for Fed Chairman Jerome Powell to cut Interest Rates,” accusing Powell of “playing politics” and being “always TOO LATE AND WRONG.”

READ: DOJ Releases Documents Confirming MS-13 Membership Of Deported El Salvador Man

Trump contrasted the Fed’s inaction with the European Central Bank, which he noted is expected to cut rates for the seventh time, adding, “Oil prices are down, groceries (even eggs!) are down, and the USA is getting RICH ON TARIFFS.”

The Fed’s independence, a cornerstone of its credibility, is now under scrutiny. The 1935 legal precedent Humphrey’s Executor v. United States protects commissioners of independent agencies like the Fed from being fired at will, ensuring monetary policy remains free from political influence. However, a pending Supreme Court case could overturn this protection, a development Powell addressed during his Chicago appearance.

“I don’t think that decision will apply to the Fed, but I don’t know. It’s a situation that we’re monitoring carefully,” he said, adding, “Fed independence is very widely understood and supported in Washington—where it really matters.”

If the court rules against this precedent, the implications for global financial markets could be profound, as the U.S. dollar’s status as a safe-haven currency relies heavily on trust in the Fed’s apolitical decision-making.

Powell, whose term as Fed chair ends in May 2026, has been a frequent target of Trump’s criticism, a pattern that echoes the president’s first term. Initially nominated by Trump in 2017 and reappointed by President Biden in 2022, Powell has staunchly defended his position.

READ: Trump Weighs Tariffs As Tool To Break China’s Stranglehold On ‘Critical Minerals’

At a November 2024 news conference, when asked if he would resign at Trump’s request, Powell responded bluntly, “No,” later asserting that his removal or demotion is “not permitted under the law.”

Financial markets are on edge, pricing in significant rate cuts later this year as Trump’s tariffs—already including a 10% baseline on all U.S. imports, 145% on Chinese goods, and additional duties on metals and cars—threaten to exacerbate inflation and slow growth.

Economists warn of a potential stagflation scenario, where rising prices coincide with stagnant economic activity and higher unemployment, a dilemma the Fed hasn’t faced in decades. Powell’s comments suggest the Fed is unlikely to cut rates soon, even if the economy falters, prioritizing inflation control over growth stimulation—a stance that directly clashes with Trump’s demands.

The tension highlights a broader debate about the Fed’s role in a politically charged environment. Trump’s tariffs, which Powell described as a “fundamental change” with no modern precedent, have already disrupted global markets, with China retaliating with a 125% tariff on U.S. products.

As the Fed navigates these uncharted waters, the looming Supreme Court decision and Trump’s escalating rhetoric cast a shadow over the central bank’s ability to act independently—a principle that has long underpinned America’s economic stability.

Please make a small donation to the Tampa Free Press to help sustain independent journalism. Your contribution enables us to continue delivering high-quality, local, and national news coverage.

Connect with us: Follow the Tampa Free Press on Facebook and Twitter for breaking news and updates.

Sign up: Subscribe to our free newsletter for a curated selection of top stories delivered straight to your inbox.