Like so many of the rulemakings being rolled out by the Biden administration, the fiduciary rule purports to protect consumers. In reality, it hurts them by limiting choice and cutting off access to essential products and services.

If political appointees and bureaucrats at the Department of Labor (DOL) care about helping the little guy, they ought to make it easier to invest and expand access to financial products and services – not harder. Americans should be empowered to chart their financial destiny as they see fit. The Biden fiduciary rule’s big government approach is a loser for main street.

The DOL is looking to dramatically expand its power over financial advisors and the people they serve. This fall, Joe Biden’s appointees at the DOL resurrected a rulemaking the Obama administration tried to push through that was ultimately blocked by a federal court on the grounds that it didn’t comply with the law.

Read: New Mexico, Arizona, And Wyoming Supreme Courts Decide Fate Of Pro-Life Jews

The Biden DOL’s proposed fiduciary rule would place a fiduciary obligation to act in the customer’s financial best interest on just about every financial services professional in America. This may sound reasonable on its face, but the rule would dramatically expand the already high administrative and compliance costs faced by stockbrokers, financial advisors, and other financial services professionals who offer investment products to Americans. All this additional red tape will increase costs for financial services firms and force them to rethink how they serve clients.

Some Americans want a financial advisor who acts as fiduciary. For those individuals, advisors who meet that high legal standard are available. Other Americans choose to employ a broker to buy and sell investment products like stocks, bonds, annuities, and insurance. In these relationships, the customer decides what to buy or sell, and the financial services professional executes the transaction.

Both models make sense for certain people. The bottom line is that it should be up to individual Americans to decide what sort of financial advisory relationship they would like to have – not the federal government. The nanny state approach Joe Biden and his DOL are pushing will have negative consequences for main street retirement savers across America.

Currently, millions of middle-class Americans rely on brokers and advisors who do not fall into the fiduciary category to help them save and plan for retirement. If this rulemaking goes through, the regulatory burden will be so great that it won’t make sense for many advisors to continue servicing smaller accounts. The cost of doing so will be too high, and unlike the federal government, businesses have to make financially sound decisions in order to stay in operation.

So, what will be the net result of the Biden DOL’s fiduciary rule proposal if it is finalized? Millions of main street Americans will have fewer options when it comes to saving for retirement and building wealth.

We have a savings crisis in this county. Millions of our citizens do not have the funds to cover emergency expenses, much less savings for retirement. Washington policymakers should be laser focused on making it easier for Americans to invest and build wealth. The DOL’s proposed rule does the exact opposite.

If the rule is finalized, it will be challenged in court and hopefully overturned due to its similarity to the Obama-era fiduciary rule that the Fifth Circuit Court of Appeals struck down in 2018. However, that process will not play out quickly. In the meantime, millions of Americas will lose access to basic financial planning services they want and need.

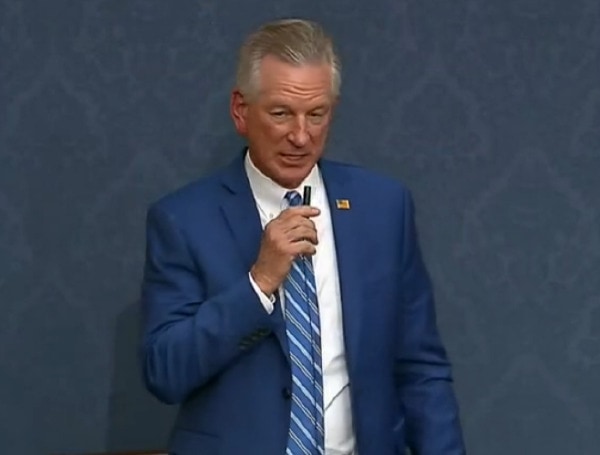

Tommy Tuberville is a Republican from Alabama serving in the United States Senate. He is a member of the Senate Committee on Health, Education, Labor, and Pensions and is Ranking Member of the Subcommittee on Children and Families.

The views and opinions expressed in this commentary are those of the author and do not reflect the official position of the Tampa Free Press or the Daily Caller News Foundation.

Android Users, Click To Download The Free Press App And Never Miss A Story. Follow Us On Facebook and Twitter. Sign up for our free newsletter.

We can’t do this without your help. Visit our GiveSendGo page and donate any dollar amount; every penny helps.