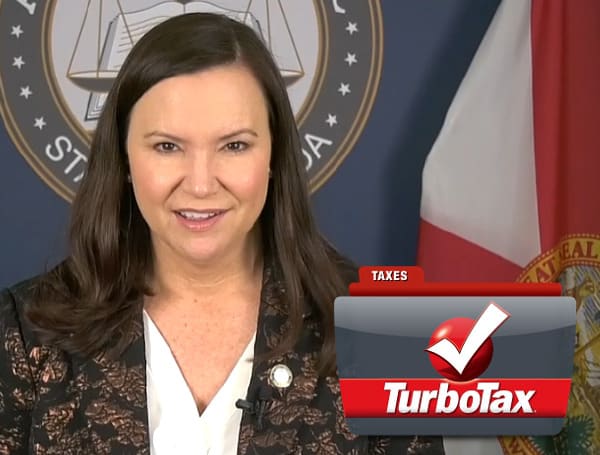

Florida Attorney General Ashley Moody announced on Monday that restitution checks are in the mail today for Floridians deceived by TurboTax’s owner, Intuit.

Moody secured more than $10 million for Florida consumers following a multistate action against Intuit for the company’s tax-preparation products.

The restitution will soon become available to more than 350,000 Floridians. Eligible consumers will be emailed about the settlement, and checks started being mailed on Monday and throughout the rest of the month.

In the news: 2 Dead, 18-Year-Old Bartow High School Senior Flown To Tampa After Mulberry Crash

Attorney General Ashley Moody said, “We have some good news for more than 350,000 Floridians who fell victim to TurboTax’s deceitful business practices. Following a multimillion-dollar multistate action by my Consumer Protection Division, thousands of restitution checks will be mailed today.”

In May 2022, Attorney General Moody announced a $141 million multistate action against Intuit for allegedly deceiving millions of low-income Americans into paying for tax services that should have been free. All 50 states and the District of Columbia signed on to the action.

Eligible consumers include those who paid to file their federal tax returns through TurboTax for tax years 2016 through 2018, they were eligible to file for free through the IRS Free File Program.

Consumers who are eligible for payment will be notified through email by the settlement fund administrator, Rust Consulting. These consumers will automatically receive a check in the mail, without filing a claim.

The amount each consumer receives will be based on the number of tax years for which they qualify. Most consumers are expected to receive approximately $30. For more information about who is covered by the settlement, and information about the settlement fund, please visit AGTurboTaxSettlement.com.

In the news: VIDEO: High School Student Pepper Sprays Teacher After He Takes Her Phone

Intuit, the parent company of TurboTax, agreed to a $141 million settlement with 44 states and the District of Columbia. The settlement was reached after the states alleged that Intuit had misled consumers into paying for TurboTax when they were eligible for free filing through the IRS Free File program.

The IRS Free File program is a government-sponsored program that allows taxpayers with incomes of $73,000 or less to file their taxes for free. Intuit is one of several companies that participate in the program.

The states alleged that Intuit had made it difficult for consumers to find and use the free version of TurboTax. They also alleged that Intuit had used deceptive advertising to make it seem like TurboTax was the only way to file taxes for free.

As part of the settlement, Intuit agreed to pay $141 million to consumers who were misled into paying for TurboTax. Intuit also agreed to make it easier for consumers to find and use the free version of TurboTax.

The settlement is a victory for consumers who have been fighting for years to make tax filing more affordable. It is also a reminder that companies must be held accountable for their actions.

Android Users, Click To Download The Free Press App And Never Miss A Story. Follow Us On Facebook and Twitter. Signup for our free newsletter.

We can’t do this without your help; visit our GiveSendGo page and donate any dollar amount; every penny helps.